As we ease into 2021, we have some great tips to help get you started and refresh your space. From the Pantone of the Year for 2021 to annual mortgage check-up tips and home maintenance strategies, we have you covered!

Thank you for your continued support and introductions!

I hope you have a wonderful year.

Pantone of the Year 2021

The Pantone Color Institute has published their 2021 Pantone trends, which features 10 standout colors as well as 5 core classics to help bring some extra spark to fashion and home this New Year.

This year’s Pantone offers a range of shades that combine a “level of comfort and relaxation with sparks of energy that encourage and uplift our moods” according to Leatrice Eiseman, Executive Director of the Pantone Color Institute. This year’s choices are not only bold and illustrative, but also combine our desire for flexibility and color choice that lasts year-round.

What’s the Inspiring Pallette this year?

On the 2021 Pantone we have an inspiring palette composed of marigold, cerulean, rust, illuminating yellow, French blue, mint, amethyst, burnt coral and vivid raspberry! Paired with these are the core hues of inkwell, gray, buttercream, desert mist and willow beige.

To utilize this year’s incredible colors, without wasting your time or money, try sprinkling them throughout your home as accents to brighten and uplift your space. Consider throw-pillows and rugs or other accent pieces such as swapping out your curtains, lampshades or even a quick reupholster on worn chairs to help liven up your space in time for the new year!

From comforting oranges and friendly yellows, to calming and restoring greens and blues, the 2021 Pantone palette is sure to infuse your year with reawakened senses and a fresh perspective!

Looking for more inspiration? Check out the Dominion Lending Centres Pinterest page.

Time to Check-In with your Mortgage!

Time to Check-In with your Mortgage!

There has never been a better time for your annual mortgage health check-up! By organizing a quick mortgage review each year, it may yield you some fruitful financial savings.

Your home loan review this year will examine the most common potential monthly savings opportunities, including high-interest credit card debt or fixed loan payments. Reviewing your mortgage terms and options annually could result in having more money left over at the end of each month – and who doesn’t want that?!

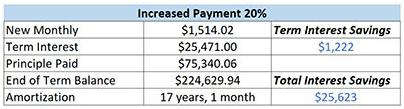

For instance, are you exercising your penalty-free extra payment privileges? Do you have any? Prepayment privileges allow you the opportunity to pay up to 20% extra per month and a total of up to 20% lump sum per year – without penalty! This means that for a $300,000 mortgage on a 25-year amortization, a 20% monthly payment increase can generate $18,000 worth of savings AND help you to pay off your mortgage 5 years earlier! When you add-on the annual lump sum of $2,500, the savings are increased to just over $25,000 for the year and bumps you up to being mortgage-free 8 years earlier! You can also use the My Mortgage Toolbox app to calculate the potential savings from extra payment.

Increasing your Monthly Payments

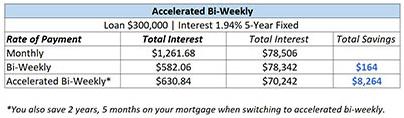

When it comes to mortgage payments, another great question for your annual check-up is whether or not you are on the best payment frequency for your cash flow and to best optimize savings! Most lenders offer various payment frequencies and an annual mortgage review can help identify the best frequency based on changing needs and cash flow situations. A monthly payment is simply a single large payment, paid once per month; this is the default that sets your amortization.

A 25-year mortgage paid monthly will take 25 years to pay off but includes the added burden of one larger payment coming from one employment pay period. Alternatively, an accelerated bi-weekly payment pays your mortgage every two weeks. This frequency allows the mortgage payment to be split up into smaller payments vs a single, larger payment per month. This is especially ideal for households who get paid every two weeks as the reduction in cash flow is more on track with incoming income.

These accelerated bi-weekly payments also offer interest savings, as you are actually making an extra payment each calendar year. For instance, a $300,000 mortgage on an accelerated bi-weekly payment schedule will pay off your mortgage two and a half years faster and generate approx. $8,000 in savings!

That’s like getting a $10,000 a year raise just by changing your payment frequency! You can use the My Mortgage Toolbox app to also calculate these payment differences.

Breaking your Mortgage Early

Another area to look at during your mortgage check-up are your penalties. Breaking your mortgage term early, and before the scheduled contract maturity date, will almost always incur a penalty. The amount depends on various factors such as how far you are into the existing term, your current interest and rate type, your existing lender, etc. However, with today’s rates sitting at such a historical low, there can still be savings! Now, if you break your mortgage early and incur a penalty, you can still come out ahead. For instance, it is possible to save $20,000 with a new low rate and incur a $15,000 penalty, which still puts you $5,000 ahead! Having an annual mortgage review can look at these options and determine if it is a benefit for you to chase these historically low rates.

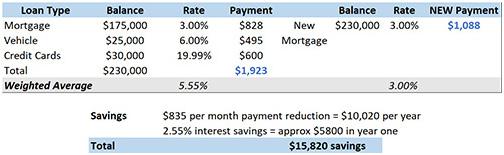

Beyond your current payments and interest rate, consumer debt outside of the mortgage is another important area for review. Did you know? The average Canadian has $30,000 of credit card debt, at approximately 20% interest?! Reviewing your home equity situation could yield $10,000 savings, per year, by rolling debts into your home equity loan. Contact me today to discuss this further and see if it is an option for you!

Debt Consolidation

Pay more to save more, pursue lower rates even with a penalty, and debt consolidation are just three examples of the financial savings an annual mortgage check-up with your mortgage professional can do! With interest rates at historic lows, now is the time to investigate all your options and perhaps save yourself thousands of dollars per year, especially if your current interest rate is over 3%! Imagine what you could do with the savings – anything from renovating or investing to going on a much-needed vacation or putting money towards your children’s education.

Completing a straightforward annual review will keep your home financing as lean and trim as possible. In other words, you will have a clean bill of mortgage health, which is just what the doctor ordered! Contact me to set up a mortgage check-up today!

New Year Home Maintenance Plan

Keep your home in comfy, cozy and working order all year long with this easy maintenance schedule highlighting important areas to check – and when!

January

Safety check! Start your year off on the right foot by ensuring your home is in proper working order. Test your smoke and carbon monoxide detectors and replace batteries as necessary.

February

The colder months are a great time to tackle indoor maintenance. Take the time to inspect your shower, tub and toilet for any leaks and recalk as needed to save you on costly repairs later in the year.

March

Inspect your windows and doors for cracks as any gaps will cause heat (and air conditioning!) to escape from your home. Add weather stripping as needed to ensure they are sealed.

April

As we get closer to spring, this is a great time to focus on the exterior of your home. A power-wash and deep clean of your siding and windows will help your home look its best.

May

With summer just around the corner, this is a good time to check your A/C unit and ensure it is up to the challenge. Contact a professional HVAC company to service your unit and ensure it is up to optimal efficiency and output.

June

As we move outside in the warmer months, this is the perfect opportunity to spruce up your deck and outdoor space. Pressure washing and resealing your deck will help keep it functional and gorgeous, all year long!

July

Insects run wild in the warmer weather. To prevent damage, it is a good idea to consider a pest control plan especially if you live in a highly active area.

August

As the end of the summer approaches and we get closer to the rainy season, you will want to ensure your roof is in good working order. Check the areas around your eaves and gutters for any water damage and ensure there are no leaks or loose shingles that could cause issues down the road.

September

To create that warm and cozy fall atmosphere, you will want to ensure your fireplace is doing its job. This is the perfect time for a thorough inspection of your fireplace – whether wood or gas – to ensure everything is working well.

October

With the gorgeous colors of fall in full swing, October is a great month to touch up the exterior of your home’s paint and boost your curb appeal. While you’re at it, make sure to check your foundations for any damage that could worsen in the colder months.

November

As the leaves start to fall, it could spell a mess for your home. In November, focus on leaf and gutter cleanup. Regularly rake your yard to keep your grass green and collect any debris that may have collected in your gutters or your roof from high winds.

December

You made it! Another year of home maintenance is almost done as we move into December. Get yourself snow ready by prepping your pipes and considering added insulation to keep them from freezing.